Automotive Storage: Then, Now, and Full Speed Ahead

The automotive industry is going through a revolutionary stage, and in the process generating a whole new world of applications around safety, connectivity, and entertainment. Among these applications are high-definition 3D maps, advanced driver-assist systems (ADAS), autonomous computers, enhanced infotainment, over-the-air (OTA) updates, and vehicle-to-everything communication (V2X), all of which require on-board data storage. The evolution of storage has taken a front seat as cars require increasing amounts of storage to enable applications both inside the car and outside in evolving infrastructures.

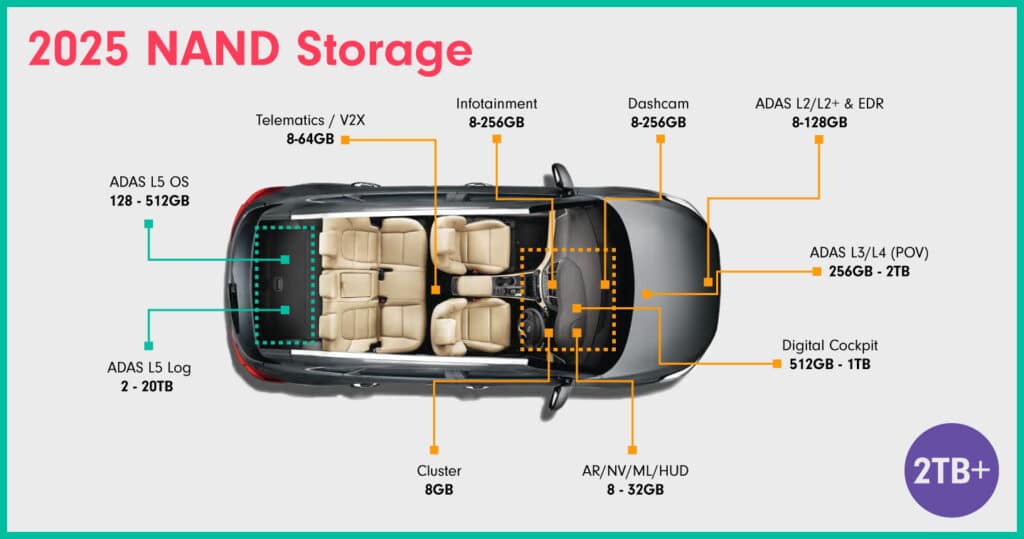

Research from Counterpoint, a global industry analysis firm, estimates that over the next decade, the storage capacities needed will range from a minimum of 2TB to as much as 11TB to support the needs of in-vehicle storage at different autonomy levels.

How did automotive storage arrive at this juncture? The technology has a deeper history than some might expect.

Mapping with HDDs

Navigation came first, according to Larry Swezey, a vice president of sales with Western Digital. Swezey was with HGST in Japan at the time but remembers early map data being stored on DVDs. They were cumbersome and difficult to update. “Automotive customers were looking for media that could record easily, and hard disk drives (HDDs) were the most reliable storage mediums in the world,” said Swezey. While NOR flash had been used in cars for powertrain engine control since the 1990s, it was limited by capacity.

While some questioned how an HDD drive with its moving parts could work in a car, shock and vibration were not the issue, according to Swezey.

“The question was how can you get HDDs to deal with the very extreme temperatures? Whether you’ve parked your car outside your favorite mall in Minnesota where it’s 10 below (-23°C) or in Arizona where it’s over 100 degrees Fahrenheit (38°C), you want your navigation system to work.” In addition to extreme environmental conditions, heat generated by the power consumption in the internal electronic board can exceed 210° F (90°C).

The company’s Emerging Products business unit completely redesigned a mobile HDD for automotive in 2003, from its heads to its media, to deal with temperature extremes.

“[After the redesign] we had this incredibly reliable drive with under 50 defective parts per million [DPPM], which was unheard of at the time,” said Swezey. “It had the extremely low failure rate the automotive customers needed to make HDD based navigation systems a standard item in their cars.”

Two roads converge

Raya Kozlov, director of Customer Quality at Western Digital, is no stranger to reliability. In 2000, she was on the quality and reliability team at MSystems (SanDisk acquired MSystems in 2006, and Western Digital then acquired SanDisk in 2016) where she first explored NAND flash for automotive.

With a budget of just $10,000, she and her research team were challenged to conduct a test to see if embedded NAND flash could operate in minus temperatures, a prerequisite for the unpredictable weather changes automotive vehicles must face. To everyone’s delight, the technology withstood temperatures of minus 40 degrees Celsius.

The introduction of NAND flash technology allowed users to overcome NOR’s capacity limits for on-board storage of features like map data and multimedia infotainment systems. NOR is still used today for powertrain and transmission control units.

Flash forward

During the next few years, NAND flash became more prominent with the rise of mobile phones and music devices. Removeable SD cards designed for automotive were created to store map data, music, and in the case of race cars, drive recorders.

When flash evolved to provide the same capacity at a comparable price, automakers embraced it. Smaller in-vehicle infotainment (IVI) units were under development and needed the smaller size that flash could provide.

“At the beginning, NOR flash was unreliable and susceptible to high temperatures,” said Swezey. But as flash advanced and was able to withstand both temperature and environmental stress, the automotive storage industry was able to transition to flash easily.

Western Digital introduced its first e.MMC designed for automotive leveraging embedded flash storage technologies it had created for the mobile market. These NAND devices were designed to support the harsh environments with underlying reliability and met the quality standards automakers require.

“Power, performance, and latency are important, but if you don’t have quality and reliability built into the product, that is like a complementary part,” said Kozlov. “For automotive, that is not complementary but actually the first part.”

Western Digital also introduced the industry’s first TLC 3D-NAND-based e.MMC for automotive to support advanced IVI, telematics, and digital clusters. The move to 3D-NAND enabled increased scalability as these applications demanded higher capacities.

The company also developed the first automotive-grade UFS based on TLC 3D-NAND to support even higher capacities and performance for drive recorders, e-cockpits, ADAS, and AI-enabled autonomous drive systems.

Infrastructure at full speed ahead

The automotive market has accelerated in the past five years on the road to full autonomy. Vehicles are not simply mechanical engines but are now data centers on wheels, driving a new generation of storage infrastructure needs as OEMs race to add connectivity and ADAS features.

“We’re at an inflection point in the market and it’s changing quickly,” said Brendon Hutton, managing director at ActiveRep GmbH, who has worked closely with Central Europe’s leading OEMs, tier one, and tier two suppliers since the early days of automotive storage.

As ADAS, multiple cameras, machine vision, and streaming evolve in future vehicles, 5G brings a low latency connection to the external world which requires a lot of high-performance processing for those to work simultaneously, Hutton explained. He added that the speed of advancement and variety of technology needs in vehicles is a large contrast to other consumer products like televisions.

“Whether it’s the metaverse, 3D mapping, processing power, transmission speeds, innovation is not slowing,” said Hutton. “It’s no longer about bits and bytes, but it’s about infrastructure.”

“Cars are now nicknamed ‘data centers on wheels’. But as autonomous vehicles increasingly exchange information outside of the car, they will rely on actual data centers,” said Matteo Zammattio, field application engineer at Western Digital in Italy. “And not just traditional data centers, but edge data centers are needed along the road to allow computation of raw-sensor data.”

Autonomous driving does not happen inside the vehicles alone; the infrastructure outside of the vehicle plays an increasingly important role. Cloud computing brings a supporting infrastructure to edge data centers that can deliver much faster response times than traditional data centers. As vehicles advance from Level 0-5 autonomy, increasing amounts of storage will be required to support ADAS.

Automotive at the leading-edge in innovation

“When you speak to automotive executives, they say automotive has overtaken consumer from a leading-edge perspective,” Hutton said. “It used to be that consumer was always leading-edge and automotive took a consumer product and adapted it, but it’s flip-flopped and now they see themselves as the innovators of technology as well as the leaders from a high-performance perspective.”

However, long design cycles due to qualifications, certifications, and regulations that vary across borders mean that automakers need to consider storage many years before a new application becomes available.

It’s the varied regulations across borders that delays full speed ahead, according to Hutton.

A recent McKinsey survey found that most respondents expect L4 use cases to emerge by 2024 or 2025. Another report estimates passenger vehicles with L5 autonomy won’t be on the road until the later this decade or the early 2030s.

It may still be a while before autonomous driving is mainstream, but storage will inevitably be in the driver’s seat.