The New Era of NAND: A Conversation with Rob Soderbery

Today at FMS 2024, Flash Business EVP and GM Rob Soderbery took the stage to deliver a view of the changing dynamics in the NAND market. We had a chance to catch up with Soderbery and discuss those dynamics, their span across capital, innovation, and technological shifts, as well as the end of what he refers to as the “layers race.”

The NAND market is complex, and the manufacturing processes that create viable NAND nodes, and eventually products, even more so. These conditions are exacerbated by supply and demand dynamics in an emerging era where new applications, especially AI, will greatly increase the need for both compute and storage.

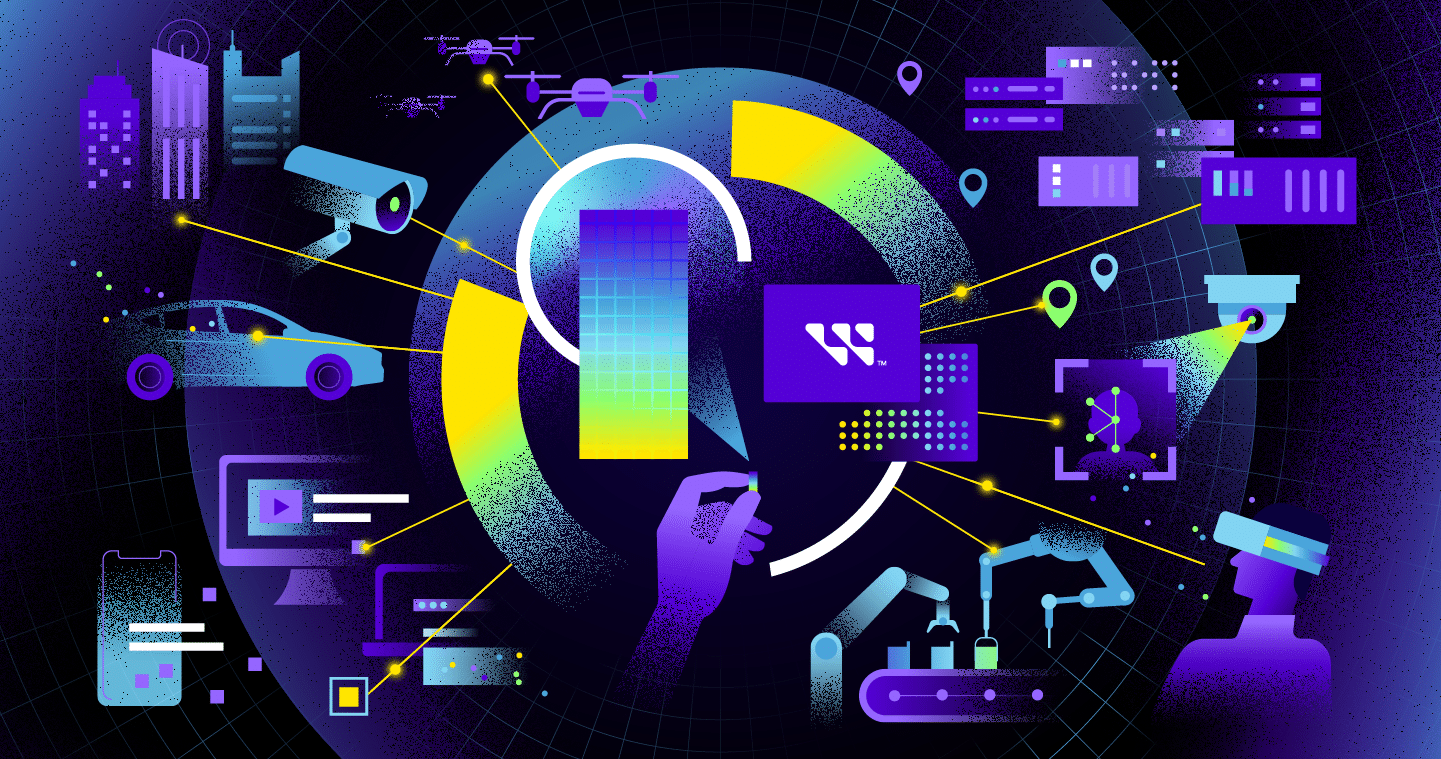

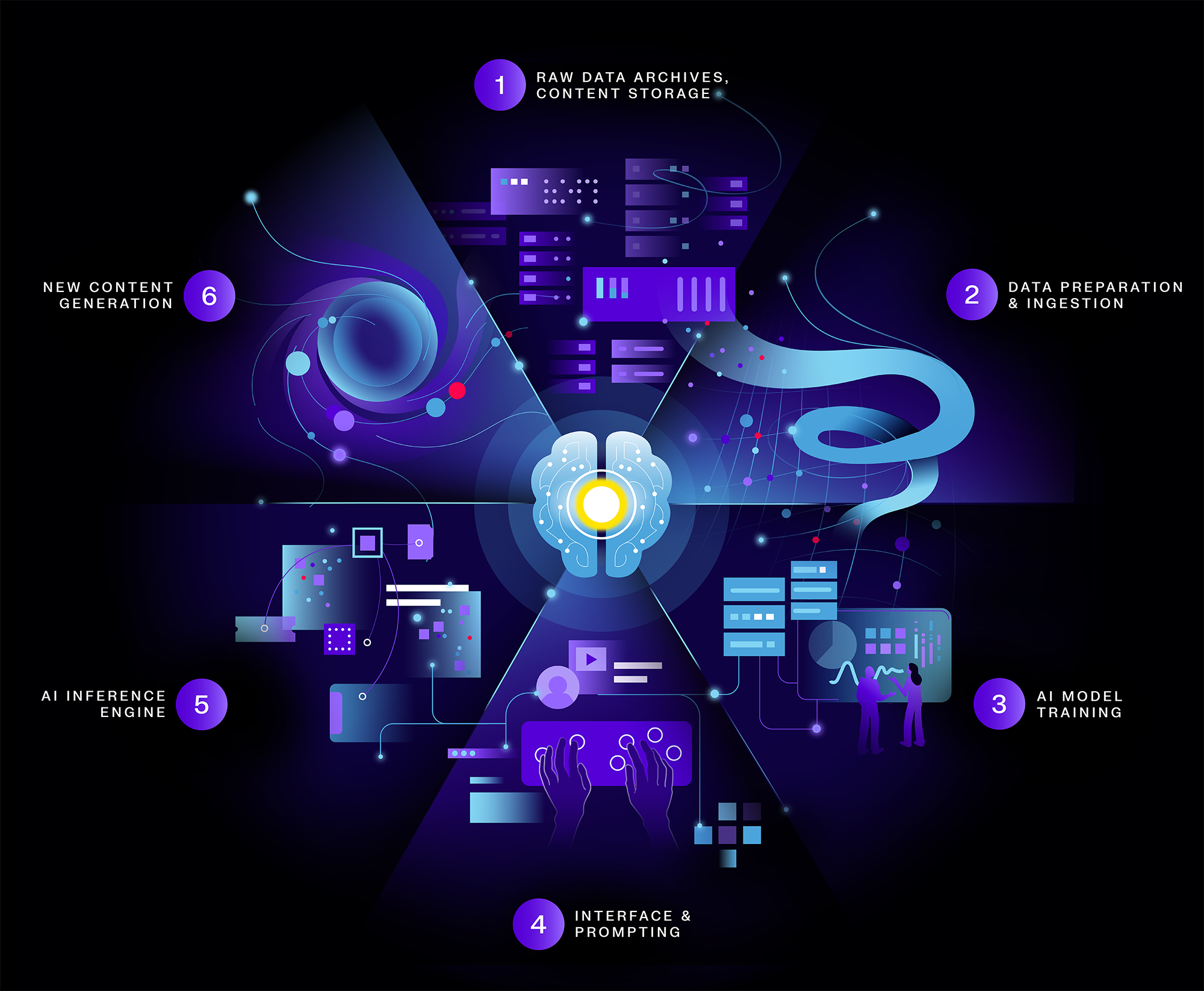

In response to the changing market and its shifting economic drivers, Soderbery and the flash business at Western Digital recently mapped out the AI Data Cycle, an architecture that shows the virtuous cycle where storage feeds AI models, and AI in return demands more storage.

The company also took a new approach to defining and architecting the guiding principles for NAND leadership, namely focusing on the features that are most important to customers—performance, capacity, and power—to prepare the company and the market for this new era.

In the assessment of this New Era of NAND—a name Soderbery gave an investor event he and two expert colleagues hosted in June—Soderbery saw an opportunity.

“It’s funny that the technology industry has applied very disciplined economic decisions to spaces like Web 2.0. Areas like e-commerce, travel booking, digital marketplaces, and all these areas in tech that have applied basic economic constructs,” Soderbery said. “It just struck me as very strange that in a capital-intensive, canonic market, the industry was not applying a rigorous economic framework.”

Instead, at the time, market leaders historically operated on a more intuition-based decision process. The application of such an economic framework, Soderbery says, will allow Western Digital to more accurately forecast demand, interpret elasticity, and anticipate other economic factors. It will also change the decision processes within the flash business to assess the direction of the market down to a more granular detail.

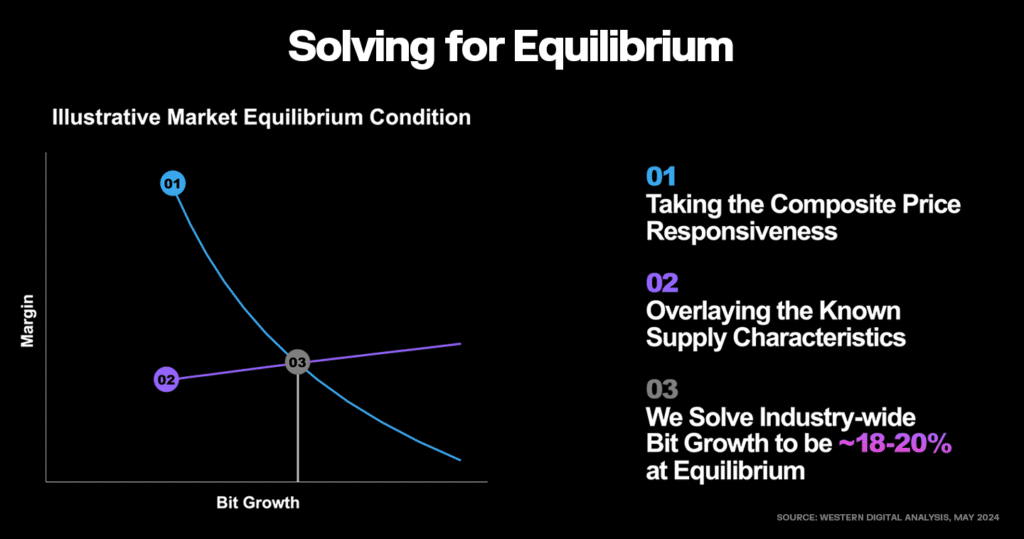

Previously, Soderbery said, most major NAND industry players applied capital investment and manufactured NAND toward a static bit growth rate goal of around 30%, assuming the demand would always be there to soak up the growth.

“That’s what we tried to express in the New Era of NAND, that you can quantitatively model all of [these dynamic factors],” Soderbery said. “And when you do that, it tells you some things about how the market is going to behave. Then we can make decisions based on that.”

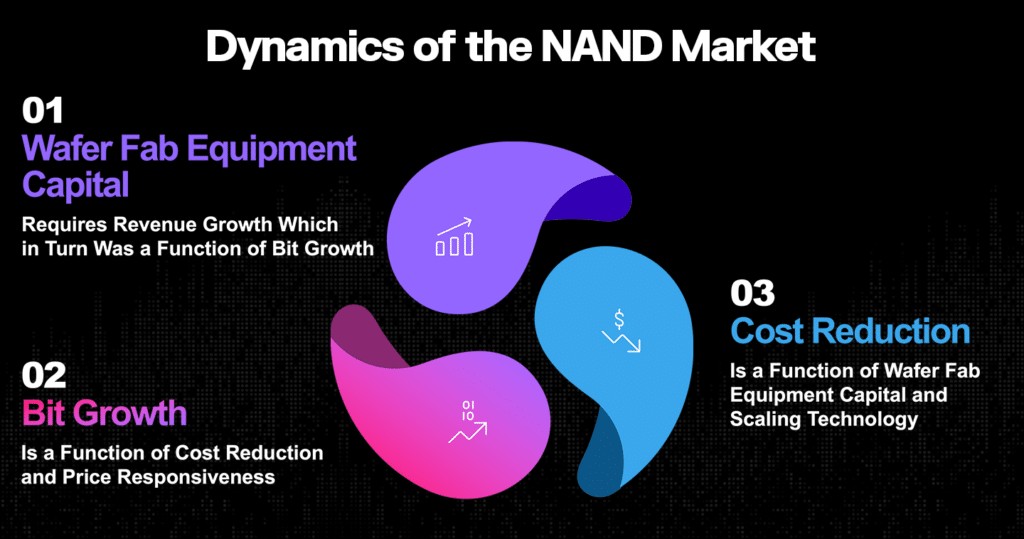

By factoring more accurately the demand and supply curves, Soderbery and his team are finding ways to solve for an equilibrium among the major factors of the NAND market. Those factors are capital expenditure, bit growth, and cost reduction.

The end of the layers race

The NAND market, news outlets, and even NAND customers have been a bit over-obsessed with layers, where more is always better. The assumption is that more layers mean more bit density and capacity, leading to a cost advantage, and therefore, whoever produces the product with the most layers “wins.”

“The layers race was the notion that if I can deliver more layers, I could get a cost advantage, and therefore I could get an advantage in the marketplace,” Soderbery said.

But with 3D NAND, it’s no longer that simple. If you think of a skyscraper, the more floors an architect adds to the construction, the more tenants one could fit into a single building. But just like in physical building construction, the higher you make it, the more complex and expensive the construction process becomes. At some point, the cost of adding additional floors to the building isn’t a static increase, but instead the cost grows exponentially.

The more layers NAND makers add, the higher the complexity and costs of manufacturing, which changes the relationship to the economic drivers that dictate cost, performance, and capacity.

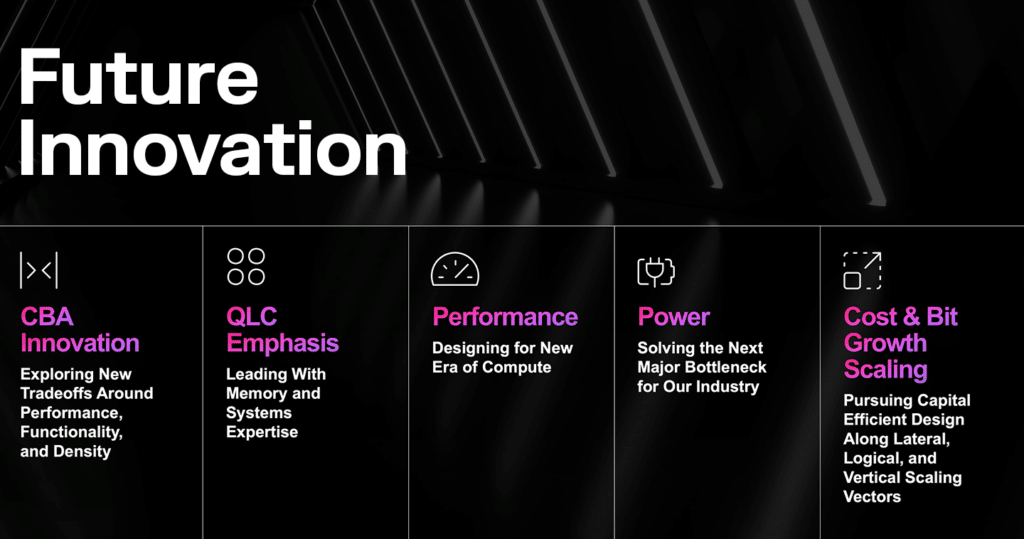

“The thing that’s happened is the rate of cost decline has gone down. At some point the math inverses and you don’t get the same benefit,” Soderbery said. “We are going to deliver more layers. We’re going to continue innovating, but we just don’t see [more layers] being the core economic driver of NAND anymore.”

The new modeling has Soderbery and his team in constant analysis mode to keep more agile around business decisions.

“It’s the exact opposite of the normal long-range planning model, where you get together once a year and set the plan, then three weeks later the plan is outdated,” Soderbery said. “We’re not doing a business plan once a year. We do the business plan literally once a week.

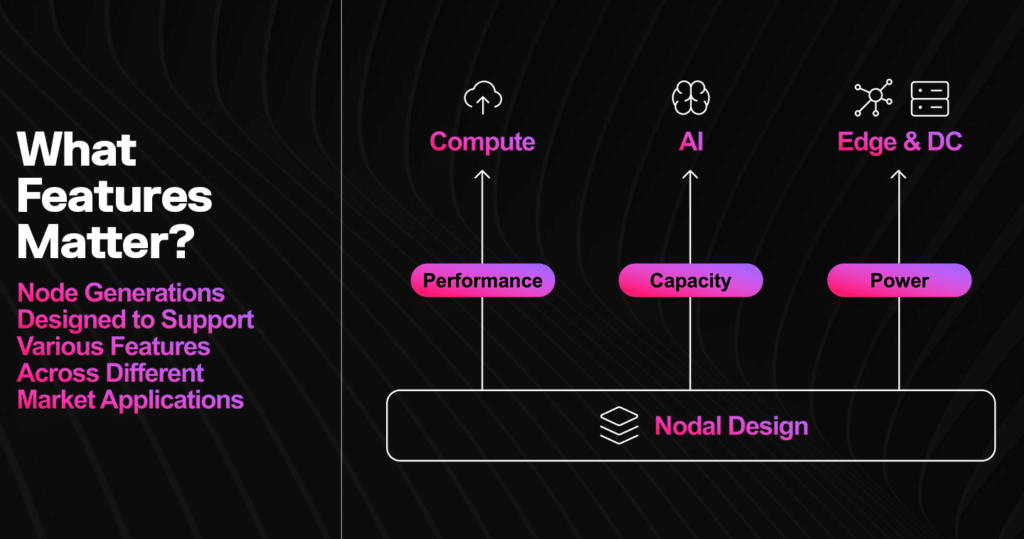

In the New Era of NAND, the requirements around flash are more nuanced and specific to the use case. What one builds will dictate how the flash inside it should operate—how big it should be, how much capacity it holds, and how much power it will consume.

Three requirements of flash

For Soderbery and the Western Digital flash business, the most important constituents of flash are three things: performance, capacity, and power.

“The competitive dimensions of flash have now changed,” Soderbery said. “In the layers race era, it was just layers and cost. Now you basically need to understand three different things. You need to understand performance, capacity, and power because those are the big drivers.”

System needs for flash storage are not necessarily always biggest capacity and fastest speed possible. Those two aspects of flash potentially could make them operate at higher temperatures or necessitate a bigger footprint inside a device, which might be unacceptable depending on what the device is.

“Every application you consider as having performance, capacity, and power as the competitive trade-offs. And what we’ve shown with the Western Digital portfolio is that we’re delivering NAND that is leading in all three of those dimensions. When I talk to customers, those are really important factors, especially in AI,” he said.

The AI frontier

In AI, Soderbery sees an emerging but nascent industry that is on the verge of a severe ramp up in demand.

“With the AI Data Cycle, we outlined what is happening with storage in AI. But it’s early. People are mostly applying existing technologies to AI, versus applying AI-optimized technology. But AI actually illustrates those three dimensions I’ve talked about,” he said.

Performance, power, and capacity play a major consideration at every phase of the AI Data Cycle, as each stage demands something different. Whereas the initial stages need massive capacity to contain as much data as possible for model training, as data goes through the cycle, speed and performance may be the more important factors.

For this budding space, Soderbery and his team are applying their efforts to build technology and products that address the three main needs discussed above. These are the high-capacity enterprise SSDs for AI data preparation and faster data lakes, QLC and TLC drives for fast performance, and PCIe Gen5 compute enterprise-grade SSDs for the highest performance and best power efficiency for large language model (LLM) training, inferencing, and AI service deployment.

“From a customer perspective, customers are going to need to be more thoughtful about not just what is the latest node, but what is the node that is most optimized for their particular use case,” he said. “We believe there are plenty of bits out there for premium use cases, and a key part of our strategy is to rotate our bits to the highest and best use in the marketplace.”

Also on the horizon is the BiCS8 218-layer NAND that uses circuit bonded array (CBA) technology, which is showing great promise for improvements in memory and layer density, latency, and transfer speeds.

To learn more about the New Era of NAND, watch the investor event here. To learn more about the AI Data Cycle, see the presentation here.