How is AI Clearing the Vision of Smart Video?

New Survey Finds Hard Disk Drives Leading Storage in Smart Video Systems while High-Endurance Flash is Fueling Smart Cameras

Ask the security systems integrators we polled in our recent survey, and they will tell you that storage is the backbone for capturing, retaining and analyzing data. More than ever, they’re relying heavily on hard disk drives (HDDs) and flash because capacity and endurance matter. The industry is moving beyond traditional security-focused surveillance and is adopting new use cases that could be referred to as smart video – cameras, storage, processing and deep learning algorithms combined to deliver solutions that make people’s experiences better.

AI and Analytics Trending as Highly Important

In the survey, commissioned by Western Digital, the respondents reacted to a set of statements with 76 percent agreeing that video analytics and artificial intelligence (AI) are playing an ever-increasing role in their field. The desire to gain insights from new technologies is always there – and it’s natural that data analytics and AI have become very important in the rapidly growing area of smart video recording.

But wait – there’s a lot more!

While AI and data analytics had the most mindshare, 74 percent of respondents saw remote management and configuration of video storage as essential. When asked if having onboard storage in a camera was important, 70 percent agreed.

I believe the responses indicate an undercurrent of change is flowing — that increasingly, customers want more from their higher resolution cameras and recorders — they want to be able to make decisions based on real-time and historic data saved to the storage hard drives and microSD cards in these devices. This may also require an ecosystem of partners with AI software and accelerators, but also lots and lots of storage.

Smart Video Opportunities – Eye see what you did there.

The survey results suggest the largest smart camera deployments in 2019 were in office and commercial buildings, followed by industrial manufacturing, and schools and universities. When asked about the next 3-5 years – those surveyed expect schools and universities will be the fastest growing area for deployments, followed by office and commercial buildings, government facilities, and retail and entertainment. Smart city camera use cases such as city parking and public transportation facilities present a growing opportunity for security integrators as well, and may quickly catch up to the others in widespread use.

Businesses, retailers, governments and enterprises are looking for easier building access, more automation, more efficient parking and transportation systems, and the ability to manage cameras and recorders remotely. The role of HDDs in video recorders and high-endurance flash in smart cameras are moving the industry to these smarter video use cases that can drive value by providing actionable insights to their businesses.

For example, companies like Western Digital’s partner AngelTrax, can serve the growing transportation market by using software that pulls in cameras and storage to manage bus and other fleet vehicles for better productivity, efficiency and safer fleet management.

AngelTrax President and CEO Richie Howard says, “When we entered the mobile video market more than 20 years ago, our clients were using storage primarily to provide a record of activity and incidents taking place on school buses and other types of vehicles, and the video was archived at the end of the day, if desired. Today, with storage from Western Digital, our clients still record and store video at HD 1080P resolution or higher — and in much greater storage capacities — plus metadata such as GPS coordinates, street map locations of stops along the way, vehicle speed and AI-enhanced driver behavior detection to indicate aggressive or distracted driving.”

HDDs or Flash? It Depends…

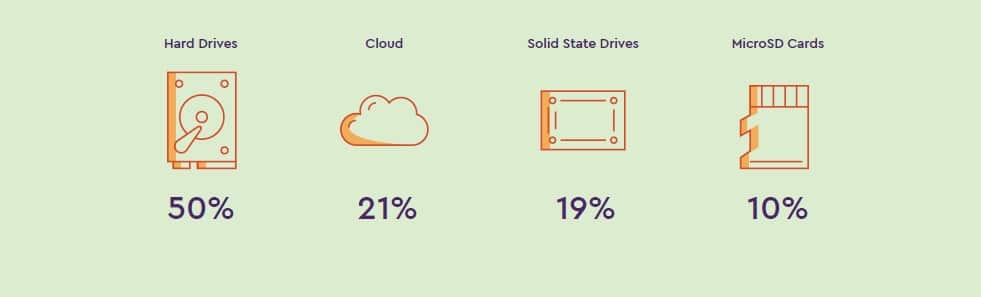

The survey found that types of storage used in deployments is a mix — led by HDDs. Respondents reported they have HDDs installed in 50 percent of their installations and they cited endurance, reliability, performance and capacity as the top features. At the same time cloud-based systems, solid-state drives (SSDs) and onboard microSD cards are adding to the smart video deployments, being used on 21 percent, 19 percent and 10 percent of systems deployed by the respondents, respectively.

As higher resolutions become more common on cameras, both drives and microSD cards are increasing in capacity to accommodate the growing size of video and image files. The use of microSD cards for onboard camera storage in cameras is increasing, both as primary storage and for backing up cloud-based systems. The microSD cards are often placed in hard to reach areas, making them less accessible for service. Respondents cited the ability to check the health of microSD cards deployed in cameras as a key product feature.

Methodology

The independent survey, commissioned by Western Digital, was conducted by Emerald, an operator of business-to-business trade shows, conferences, content and media products in the United States. The survey was sent to surveillance solutions providers and integrators and 157 chose to give their views on technologies, trends and use cases for storage in smart video solutions deployments. The survey was conducted via email and offers a 90 percent confidence interval, which has a z-score (a critical value) of 1.645. The survey margin of error is 2.52 percent.

Learn More

- Survey: The Western Digital Smart Video Storage Survey

- AngelTrax Case Study: Ready for the Rise of Smart Fleets?